RVs were never cheap. And since the COVID-19 pandemic began and global supply chains tightened, costs have skyrocketed. Today, even entry-level RVs can cost over $20,000! That’s a lot of money for a mobile weekend getaway.

Unless you’re lucky enough to have $30,000 cash burning a hole in your pocket, you’ll need to finance your RV purchase. Most buyers apply for an RV loan.

In our insider guide to RV financing, we explained the overall process of financing an RV purchase. In this post, we’ll be focusing on the RV financing loan itself. This guide is primarily for buyers of new RVs considering whether to finance their purchase. We’ll answer important questions like:

- How much will my RV loan cost?

- What are typical RV loan terms?

- What is a typical RV loan interest rate?

- What is a good credit score for an RV loan?

Introduction to RV Loans

RV loans work much like a car loan (not so much like a home mortgage). A financial institution, such as a bank or credit union, lends you the money to finance the purchase. You pay that money back over an agreed amount of time, plus interest.

Most RV loans are secured loans with the RV itself as collateral. You don’t truly own the RV until the loan has been paid in full. The bank is the lienholder, the party that owns your loan. If you default on your loan payments, the bank will repossess your RV. You won’t get any money back.

RV loans are more difficult to obtain than auto loans. An RV is considered a luxury purchase. And usually, the price is higher. So lenders may consider factors like liquidity, net worth and cash flow.

Because different lenders offer different terms, you should always shop around. Most lenders will perform a “soft credit pull” before offering you a loan. A soft credit pull does not affect your credit score. So don’t be afraid of getting a second opinion. Don’t, however, allow more than 2-3 “hard pulls” on your credit report when comparing lenders.

How Much Will My RV Loan Cost?

So you want to know exactly how much your RV loan will cost? You’re in luck! We built an interactive calculator just for that! It’s the most comprehensive RV loan calculator on the web. You can account for trade-in values, rebate discounts, sales tax and more!

Fun fact: Most financing contracts will also often include a one-time set-up or application fee ranging from $50 to $500.

Typical RV Loan Terms

Because RVs are more expensive than automobiles, the loan terms are correspondingly longer. Terms up to 10 years are common for travel trailers and 5th wheels, and terms up to 20 years are possible for luxury motorhomes.

- 2-7 Years: For smaller advancements, like $20,000 or less, you can often get a short-term loan up to 84 months.

- 10-12 Years: This is the typical term length for an RV loan of less than $50,000 – $100,000 with 10-20% down.

- 15-20 Years: Some lenders will offer terms up to 20 years for loans exceeding $50,000, usually used for Class A coach or luxury 5th wheel purchases.

Factors in the Price of RV Loan

The lifetime cost of an RV loan depends on five factors:

- Loan Amount

- Down Payment

- Interest Rate

- Term Length

- Payment & Amortization Schedule

Loan Amount

Most RV loans are between $10,000 and $50,000. This assumes you are purchasing a new RV from a dealership.

Some lenders have minimum financing requirements. Southeast Financial, for instance, will finance a minimum amount of $15,000. In other words, they will not offer loans less than $15,000. Bank of the West has a minimum financing amount of $10,000.

Other lenders have maximum financing requirements. Lightstream offers financing up to $100,000, for instance, while Alliant Credit Union offers loans up to $300,000. Bank of the West will finance up to $2 million!

The higher the loan amount, the more you pay in interest over time. And the higher your credit score must be.

Down Payment

Similar to a mortgage, most RV loans require 10 – 20% down. Banks and credit unions tend to require 20% down; lenders who specialize in RV finance tend to require 10% down.

The larger the amount financed, the higher the required down payment may be.

You should maximize your down payment. A large down payment will both reduce your interest rate AND further reduce the total amount you’ll pay in interest over the life of your loan.

- Some dealerships will accept an RV trade-in for a down payment.

- Some dealerships offer 0% down promotional financing. These offers are limited to buyers with excellent credit, however, and the interest rates will be higher.

- It’s almost impossible to find same-as-cash RV financing, sadly.

Interest Rate

The interest rate is based on two factors:

- Market rate

- Your credit score

The market rate is generally tied to the prime rate, which is in turn based on the federal funds overnight rate. Most mortgages, small business loans, and consumer loans are based on the prime rate. You can check the current prime interest rate here.

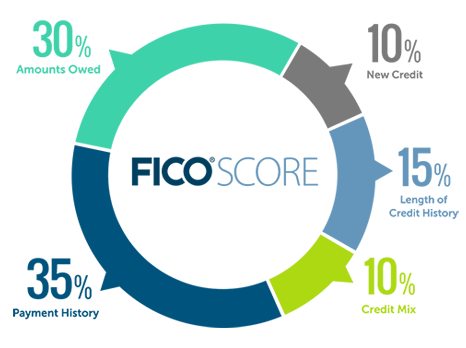

Your lender may increase your interest rate above the prime rate based on their lending policies and your personal credit score, which is based on your outstanding debt, income, employment history, payment history, credit account age, and several other factors. The higher your credit score, the better your interest rate.

If you have a poor credit score, you may need a co-signer or co-buyer to complete your loan. Be aware, however, that many lending institutions don’t allow co-signers on RV loans – only co-buyers! (Which must live at the same address).

While many institutions may offer loans to buyers with credit scores as low as 550-580, these offers are few and far between. Plus, interest fees will be exorbitant. Instead, you should aim for a minimum credit score of 670 to finance your RV purchase. Scores above 720-750 will net you the best interest rates.

You want as low an interest rate as possible. But the interest rate isn’t the only thing that matters! A short-term loan with a higher interest rate may actually cost you less than a long-term loan with a lower interest rate.

As of April 2022, here are some sample rates for RV secured loans:

- Excellent: 3-5 percent

- Good: 5-7 percent

- Fair: 7-9 percent

- Poor: 9-12 percent

- Awful: 12+ percent

Term Length

The RV loan term is the length of your loan. Since virtually all RV loans are fixed-rate, fixed-term loans, this number is very easy!

Most RV financing loan terms are 5-12 years, with a few outliers as little as 1-3 years and as many as 15-20 years.

- 2-7 Years: For smaller advancements, like $20,000 or less, you can often get a short-term loan up to 84 months.

- 10-12 Years: This is the typical term length for an RV loan of less than $50,000 – $100,000 with 10-20% down.

- 15-20 Years: Some lenders will offer terms up to 20 years for loans exceeding $50,000, usually used for Class A coach or luxury 5th wheel purchases. Typically, loans up to $100,000 are eligible for 15-year terms, and loans over $100,000 are eligible for 20-year terms.

As a rule, the shorter the term, the less you’ll pay in interest – even if the interest rate is slightly higher on the shorter-term loan! You should

However, because you’ll pay off the loan in a shorter period of time, the monthly payments will be higher on a shorter loan. You should not accept a loan with a monthly payment greater than you can reasonably and comfortably afford.

What many buyers do is a best-of-both-worlds approach: Smart buyers might finance an RV on a conventional 10-year RV loan but overpay every month. In this way, they pay off the loan early and reduce interest charges. However, in a financial pinch, they can always lower their monthly payment to the minimum required.

Payment & Amortization Schedule

Most RV loans are fixed-payment loans: That is, you’ll pay the same monthly payment every year until your loan has been paid off.

But some RV loans, especially ones offered by dealerships such as General RV or credit unions Wildfire, are balloon payment loans. In this structure, you’ll pay a lower monthly payment for all but the last month of your loan – but on the last month, you owe big! In one instance, a buyer had a balloon payment of over $100,000!

Read your finance contract carefully! Don’t accept a loan with a balloon payment unless you’re doubly sure you can afford the final payment. Don’t assume you’ll just refinance later to extend the term and avoid the balloon – you don’t want to get stuck with a five-figure bill!

Most loans are structured so that the bulk of the interest is paid off first. For instance, out of the first $300 payment, perhaps $200 goes just towards interest! In other words, you don’t build much equity for the first few years. As time goes on, more and more of your payment goes towards the principal.

Here is a sample amortization schedule for a 7-year, $30,000 loan with an interest rate of 6.2%. As you can see, you pay $1,760 in interest charges the first year – compared to just $173 the last year!

| Payment Number | Payment | Principal | Interest | Balance |

|---|---|---|---|---|

| 1 | -$441.14 | -$286.14 | -$155.00 | $29,713.86 |

| 2 | -$441.14 | -$287.62 | -$153.52 | $29,426.24 |

| 3 | -$441.14 | -$289.10 | -$152.04 | $29,137.14 |

| 4 | -$441.14 | -$290.60 | -$150.54 | $28,846.54 |

| 5 | -$441.14 | -$292.10 | -$149.04 | $28,554.45 |

| 6 | -$441.14 | -$293.61 | -$147.53 | $28,260.84 |

| 7 | -$441.14 | -$295.12 | -$146.01 | $27,965.71 |

| 8 | -$441.14 | -$296.65 | -$144.49 | $27,669.07 |

| 9 | -$441.14 | -$298.18 | -$142.96 | $27,370.88 |

| 10 | -$441.14 | -$299.72 | -$141.42 | $27,071.16 |

| 11 | -$441.14 | -$301.27 | -$139.87 | $26,769.89 |

| 12 | -$441.14 | -$302.83 | -$138.31 | $26,467.06 |

| 13 | -$441.14 | -$304.39 | -$136.75 | $26,162.67 |

| 14 | -$441.14 | -$305.96 | -$135.17 | $25,856.71 |

| 15 | -$441.14 | -$307.55 | -$133.59 | $25,549.16 |

| 16 | -$441.14 | -$309.13 | -$132.00 | $25,240.02 |

| 17 | -$441.14 | -$310.73 | -$130.41 | $24,929.29 |

| 18 | -$441.14 | -$312.34 | -$128.80 | $24,616.96 |

| 19 | -$441.14 | -$313.95 | -$127.19 | $24,303.00 |

| 20 | -$441.14 | -$315.57 | -$125.57 | $23,987.43 |

| 21 | -$441.14 | -$317.20 | -$123.94 | $23,670.23 |

| 22 | -$441.14 | -$318.84 | -$122.30 | $23,351.38 |

| 23 | -$441.14 | -$320.49 | -$120.65 | $23,030.90 |

| 24 | -$441.14 | -$322.15 | -$118.99 | $22,708.75 |

| 25 | -$441.14 | -$323.81 | -$117.33 | $22,384.94 |

| 26 | -$441.14 | -$325.48 | -$115.66 | $22,059.46 |

| 27 | -$441.14 | -$327.16 | -$113.97 | $21,732.29 |

| 28 | -$441.14 | -$328.86 | -$112.28 | $21,403.44 |

| 29 | -$441.14 | -$330.55 | -$110.58 | $21,072.88 |

| 30 | -$441.14 | -$332.26 | -$108.88 | $20,740.62 |

| 31 | -$441.14 | -$333.98 | -$107.16 | $20,406.64 |

| 32 | -$441.14 | -$335.70 | -$105.43 | $20,070.94 |

| 33 | -$441.14 | -$337.44 | -$103.70 | $19,733.50 |

| 34 | -$441.14 | -$339.18 | -$101.96 | $19,394.32 |

| 35 | -$441.14 | -$340.93 | -$100.20 | $19,053.38 |

| 36 | -$441.14 | -$342.70 | -$98.44 | $18,710.68 |

| 37 | -$441.14 | -$344.47 | -$96.67 | $18,366.22 |

| 38 | -$441.14 | -$346.25 | -$94.89 | $18,019.97 |

| 39 | -$441.14 | -$348.04 | -$93.10 | $17,671.94 |

| 40 | -$441.14 | -$349.83 | -$91.30 | $17,322.10 |

| 41 | -$441.14 | -$351.64 | -$89.50 | $16,970.46 |

| 42 | -$441.14 | -$353.46 | -$87.68 | $16,617.00 |

| 43 | -$441.14 | -$355.28 | -$85.85 | $16,261.72 |

| 44 | -$441.14 | -$357.12 | -$84.02 | $15,904.60 |

| 45 | -$441.14 | -$358.96 | -$82.17 | $15,545.63 |

| 46 | -$441.14 | -$360.82 | -$80.32 | $15,184.81 |

| 47 | -$441.14 | -$362.68 | -$78.45 | $14,822.13 |

| 48 | -$441.14 | -$364.56 | -$76.58 | $14,457.57 |

| 49 | -$441.14 | -$366.44 | -$74.70 | $14,091.13 |

| 50 | -$441.14 | -$368.33 | -$72.80 | $13,722.80 |

| 51 | -$441.14 | -$370.24 | -$70.90 | $13,352.56 |

| 52 | -$441.14 | -$372.15 | -$68.99 | $12,980.41 |

| 53 | -$441.14 | -$374.07 | -$67.07 | $12,606.34 |

| 54 | -$441.14 | -$376.01 | -$65.13 | $12,230.33 |

| 55 | -$441.14 | -$377.95 | -$63.19 | $11,852.38 |

| 56 | -$441.14 | -$379.90 | -$61.24 | $11,472.48 |

| 57 | -$441.14 | -$381.86 | -$59.27 | $11,090.61 |

| 58 | -$441.14 | -$383.84 | -$57.30 | $10,706.78 |

| 59 | -$441.14 | -$385.82 | -$55.32 | $10,320.96 |

| 60 | -$441.14 | -$387.81 | -$53.32 | $9,933.14 |

| 61 | -$441.14 | -$389.82 | -$51.32 | $9,543.33 |

| 62 | -$441.14 | -$391.83 | -$49.31 | $9,151.49 |

| 63 | -$441.14 | -$393.86 | -$47.28 | $8,757.64 |

| 64 | -$441.14 | -$395.89 | -$45.25 | $8,361.75 |

| 65 | -$441.14 | -$397.94 | -$43.20 | $7,963.81 |

| 66 | -$441.14 | -$399.99 | -$41.15 | $7,563.82 |

| 67 | -$441.14 | -$402.06 | -$39.08 | $7,161.76 |

| 68 | -$441.14 | -$404.14 | -$37.00 | $6,757.62 |

| 69 | -$441.14 | -$406.22 | -$34.91 | $6,351.40 |

| 70 | -$441.14 | -$408.32 | -$32.82 | $5,943.08 |

| 71 | -$441.14 | -$410.43 | -$30.71 | $5,532.64 |

| 72 | -$441.14 | -$412.55 | -$28.59 | $5,120.09 |

| 73 | -$441.14 | -$414.68 | -$26.45 | $4,705.41 |

| 74 | -$441.14 | -$416.83 | -$24.31 | $4,288.58 |

| 75 | -$441.14 | -$418.98 | -$22.16 | $3,869.60 |

| 76 | -$441.14 | -$421.15 | -$19.99 | $3,448.45 |

| 77 | -$441.14 | -$423.32 | -$17.82 | $3,025.13 |

| 78 | -$441.14 | -$425.51 | -$15.63 | $2,599.62 |

| 79 | -$441.14 | -$427.71 | -$13.43 | $2,171.91 |

| 80 | -$441.14 | -$429.92 | -$11.22 | $1,742.00 |

| 81 | -$441.14 | -$432.14 | -$9.00 | $1,309.86 |

| 82 | -$441.14 | -$434.37 | -$6.77 | $875.49 |

| 83 | -$441.14 | -$436.62 | -$4.52 | $438.87 |

| 84 | -$441.14 | -$438.87 | -$2.27 | $0.00 |

This is important information if you might pay off your loan early. If your loan is structured so that most funds of the first payments only pay off interest, you’ll be disappointed if you think paying off your loan 8 months early will save you much money!

But if you don’t plan on paying off your loan early, the amortization schedule may not matter as much.

Sources for RV Loans

Here are the most common lenders for RV loans. Most RV-specific lenders tend to have more lenient application criteria and faster approval (sometimes same-day approval) compared to banks and credit unions.

- LightStream

- Alliant Credit Union

- Good Sam

- Bank of the West

- Southeast Financial

- Mountain America Credit Union

- GreatRVLoan

- Camping World

- USAA

- Essex

- Fifth Third Bank

Banks and Credit Unions

If you have excellent credit, high income, and a longstanding relationship with your bank or credit union, you may find that a conventional financial institution is the best choice. You work directly with the lender. You don’t have to pay a middle man. You can use the loan for almost any RV.

Banks and credit unions can also offer preapproved loans, which you can use when negotiating with sales dealerships!

The sole downside to obtaining an RV loan from a bank or credit union is the time and effort involved. Plus, you may not get same-day approval.

RV Dealerships

Most RVs are financed through dealerships – who, technically, don’t finance anything. Instead, the dealerships works through a third-party lender who specializes in same-day RV loans.

On the plus side, if you finance through a dealership, you can haggle pricing. You can get same-day approval. If you have excellent credit, you can take advantage of promotional pricing. Some dealerships even offer zero-down financing.

On the negative side, interest rates tend to be higher. There are often hidden fees and charges. And sheisty salesmen may try to “take you for a ride”!

Personal Loans

This article doesn’t include information on peer-to-peer or personal loans, which are often used for secondhand RV purchases.

FAQs About RV Loans

The Ugly Truth of an RV Loan

If you are buying a new RV … you need to know this.

Depreciation is the bane of any RV loan. Within a year, the value of a new RV will drop about 20-30%! Which means that for most of the RV loan, you will owe more than the RV is worth. In other words, if you were to sell a 2-year-old RV that has depreciated 30%, you wouldn’t make enough money to pay off your loan.

You can protect yourself against the dangers of deprecation with GAP insurance.

Does Paying Off a Loan Reduce My Monthly Payment?

For example, if you pay an extra $3,000 towards your RV loan, does that reduce the monthly payment?

Generally, no. The monthly payment stays the same. Instead, the one-time payment goes towards principal, which reduces your overall balance. You will pay off the loan in less time (and likely save money on interest), but it will not reduce your monthly payment.

Most lenders will automatically put additional monthly payments towards your principal rather than splitting it between principal and interest, but you should always double-check!

If you need to reduce your monthly payment, you will need to refinance your RV loan.

Can I Finance an RV Loan for Full-Time Living?

Yes, you can! But not all lenders will offer this. Check into lenders that specialize in fulltime RV financing, like Alliant Credit Union.

Is RV Financing Hard to Get?

If you have a strong credit history and proven discretionary income, you likely won’t have a problem obtaining an RV loan.

If you don’t have an exemplary financial history, you should probably wait until you’ve improved your credit score. If you choose not to wait, you may need a co-signer or a co-buyer.

What About Used RV Loans?

Unfortunately, options for financing really dry up for older RVs. Many lenders won’t offer loans for RVs older than 10 years.

Most buyers who purchase used RVs, especially from private parties, either A) pay cash or B) obtain a personal unsecured loan.

Buying an RV is exciting! Enjoy the experience, but don’t let dealerships pressure you into purchasing an RV before you’re ready. Buy smart; travel happy.

Andy Herrick is a blogging nerd, #8 Enneagram, wannabe bread baker, INTJ, RV industry professional, and small business entrepreneur. He can be found hanging out with his lovely wife and family, skiing, cycling, climbing, hiking, and convincing anyone who will listen why dogs aren’t really that great of pets. Also, he runs this website.

-

Andyhttps://changingears.com/author/andrew-herrick/

-

Andyhttps://changingears.com/author/andrew-herrick/

-

Andyhttps://changingears.com/author/andrew-herrick/

-

Andyhttps://changingears.com/author/andrew-herrick/