Ready to join the RV lifestyle? Exchange that whitewashed office and sterile lawn for campfires, beach sunsets and yummy hole-in-the-wall restaurants?

Well, ante up. New RVs cost anywhere from $10,000 to more than $1 million!

- Mainstream travel trailers and 5th wheels retail for $20,000 to $80,000

- Mainstream Class A, B, and C motorhomes retail for $70,000 to $250,000

- Mainstream pop-ups and folding trailers sell for $7,000 to $30,000

- Mainstream truck campers sell for $8,000 to $40,000

Because of the high upfront cost, most buyers rely on RV financing. Few pay cash in full.

If you’re considering financing your RV purchase, you need to carefully consider the upfront and long-term costs. You also need to know your lending options and what happens if you run into payment problems. Plus, if you’re a full-timer, you’ll have some unique challenges of your own!

Table of Contents

Why Should I Finance My Rv?

If you don’t have cash to finance a new RV purchase, then the answer to this question is obvious – because you have to!

But should you finance an RV purchase even if you have the cash in hand?

Here are three reasons you might want to finance your RV, even if you can afford to pay in cash in full.

- Builds your credit. If you have a limited credit history (especially no mortgage and no auto loan), then an RV loan can help to build your credit trustworthiness.

- Leverage your opportunity. Depending on your financial situation, you may come out ahead financing your RV and using that cash for a mortgage down payment or to invest in the stock market, for instance.

- GAP insurance. If you opt for Guaranteed Asset Protection (GAP) insurance in your policy, then financing an RV protects you from deprecation in the event of an accident. GAP insurance will usually pay the difference between the scheduled loan pay-off amount and the asset’s actual cash value.

- Tax deduction. If you use your RV as a part-time home or full-time dwelling, you may be able to deduct the interest paid on a secured RV financing loan.

RV Financing At a Glance

RV loans are available through banks, credit unions, RV dealerships, and online peer-to-peer lenders.

RV loans work just like other consumer loans.

- A financial institution provides the funds for the purchase. They become the lienholder for your loan.

- You pay back the loan, plus interest, over time, usually in fixed monthly payments.

- Once you pay the loan, the RV is yours, free and clear!

- If you default on a secured loan, the RV will be repossessed. You will not receive any money back. If you default on an unsecured loan, you may face bankruptcy.

An RV loan is in the middle of a car or a home loan. Obtaining RV financing is more difficult than financing a vehicle, but less difficult than qualifying for a mortgage.

The basics of other consumer loans also apply:

- The healthier your finances, the lower the interest rate you’ll get.

- The lower your interest rate, the less you’ll pay over time.

- The shorter your term, the higher your monthly payment, but the less you’ll pay in interest.

It is wisest to aim for the lowest interest rate and shortest term possible within your monthly payment budget.

Average RV Loan Interest Rates

As of November 2021, here are some sample rates for RV secured loans:

- Excellent: 4-5 percent

- Good: 5-7 percent

- Fair: 7-9 percent

- Poor: 9-15 percent

- Awful: 15+ percent

Rates for unsecured loans can be several percentage points higher for the same credit score and financial profile.

We advise never accepting an RV loan with an interest rate greater than 15 percent, and we recommend extreme caution accepting a loan with an interest rate above 10 percent. You’re throwing your money away.

Buyer Beware!

Unlike when paying off a mortgage, you aren’t building equity in your RV. RVs depreciate over time, meaning that they lose value, even if well-maintained.

- On average, an RV loses 15-30 percent of its value at the moment of purchase.

- Most RVs are worth half what you paid in about 5-6 years.

- After 5 years, most RVs depreciate about 5 percent every year.

Read our big, fat guide to RV Depreciation here.

If you plan on trading or selling your RV before you’ve fully paid it off, you may discover you owe more than what the RV is worth!

This is called “negative equity.” Unfortunately, it is a fact of life with most new RVs. These vacation-homes-on-wheels are expenses, not assets. Don’t buy one as an investment. Buy it because you love it.

Step 1. Define Your Budget

Before seeking financing, you should define A) how much you can afford for a down payment and B) what you can afford to pay per month.

But beware! You need to consider much more than your loan monthly payment. You need to also sum the following:

- Loan monthly payment (principal plus interest)

- Gasoline/diesel, propane, campground and dumping fees

- RV insurance premiums

- Expected maintenance costs

- Any storage or long-term parking fees (read our guide to RV storage here)

- Miscellaneous

You should total all your expected costs before committing to an RV purchase. You don’t want to purchase an RV only to find out there’s nothing left over for camping!

You can use our interactive RV Cost of Living calculator here.

Example: How to Calculate RV Costs of Ownership

So you want to know how much your RV really costs?

Let’s work backward.

Say you can afford a total monthly cost of RV ownership of $650. That includes the loan payment, fuel, insurance, maintenance, upkeep, campground rental, everything.

- If you plan to camp 10 times a year, with an average fuel price of $75 and an average campground site fee of $100 per trip, then you’ll pay $1,750 total over the year, or $145 per month.

- Let’s also suppose you would pay $1,076 a year in RV insurance premiums, or $89 per month.

- Let’s also set aside $1,200 a year for RV maintenance and upkeep, or $100 per month.

- You will store the camper in your backyard, so $0 for seasonal storage.

Your costs, not including the loan payment itself, are $145 + $89 + $100 + 0 = $334 per month.

Subtracted from $650, that leaves $316 per month for your RV loan payment.

NOTE: You should not include the upfront costs of ownership, such as sales tax, title and registration fees, PDI inspections, etc. These are one-time costs and do not affect your long-term monthly payments.

RV Loan Calculator Links

Use an RV loan calculator to help you estimate your monthly payments. Here are some online versions:

How to Reduce RV Loan Monthly Payment

There are four ways to reduce your RV loan monthly payment.

- Buy a smaller, cheaper or used trade-in RV.

- Negotiate a longer term. But beware! – this may significantly increase your total costs in the long run.

- Improve your credit score by paying down debt, increasing your income, or building your credit availability.

- Increase your down payment. If you can break 10 or 20 percent, you might seem major improvements in your interest rate!

If you already have a financing contract, you may consider refinancing to lower your monthly payment. This is only wise if you’ve improved your credit score or financial position, however. Otherwise, you could wind up paying more over the long run!

Step 2. Tidy Up Your Finances

Save for A Down Payment

Most RV financing lenders require a down payment of at least 10 percent of the purchase price.

If you can put down 20 percent, you’ll get even better terms.

Your down payment should be cash or cash equivalent.

The simplest way to save is to squirrel away a portion of your income in a supplemental savings account until you’ve earned enough to make the down payment.

You can also accept gifts or informal loans from family and friends.

Do not use a credit card to fund the down payment unless you are treating the credit card as a cash equivalent. This means:

- You have enough money to immediately pay off the credit card before occurring interest or;

- You use a credit card with a 0% APR promotional period, and you are 100% confident that you’ll earn enough income to pay off the down payment in full before the promotional period expires.

Do not rush the down payment! You could save thousands of dollars in interest over the lifetime of a loan by paying 20% rather than 10% down.

If you do not have enough cash for a sufficient down payment, you can ask a friend or family member to co-sign on the RV loan. However, this person is now equally responsible for the debt, and also has some claim on ownership. Therefore, it is best practice to avoid joint credit applications.

NOTE: If you are using a personal loan or unsecured loan, a down payment may not be required.

Build Your Credit Score

Generally, you can’t obtain RV financing without a good credit score.

Many lenders will not consider anything less than a 660 – 680. You should aim for a credit score of at least 720 to secure a good interest rate.

Even if lenders accept sub-660 credit scores, be careful! Interest rates with poor credit scores can be exorbitant, up to 35.99 percent! Don’t fall for the trap.

It is not wise to finance an RV when you have poor credit! Just a difference of 0.1 percentage points n interest rate will cost you hundreds if not thousands of dollars.

If you don’t know your credit score, you can obtain a free credit report from each credit bureau: Experian, TransUnion, and Equifax. This is not a “hard pull” and does not affect your credit. You are entitled to one free copy of your credit report by law.

You can also sign up with services like CreditKarma.com or any of the credit report services offered by credit card companies like Citi or Chase. These will generally return credit score estimations based on algorithms, which may or may not equal to your credit score from a particular bureau.

So wait. Do your diligence. Build your credit. And then buy.

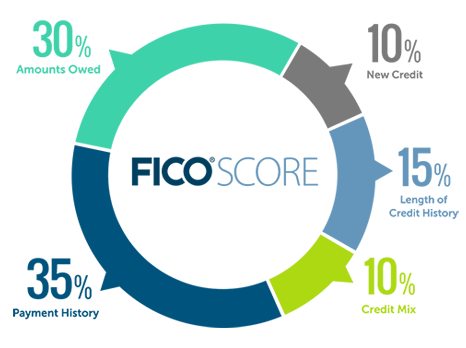

Fico Credit Score Ratings

- Exceptional/Excellent: 800 to 850

- Very Good/Good: 740 to 799

- Good/Fair: 670 to 739

- Fair/Poor: 580 to 669

- Poor/Very Poor: 300 to 579

Here are 5 ways you can build your credit score quickly for RV financing:

- Apply for one or two credit cards at least 90 days before applying for financing. Choose cards with large credit lines to boost your credit-to-debt ratio.

- Lower your carried balances. Keep all credit card balances below 30 percent, and below 10 percent is even better.

- Ensure all bills are paid in full and on time. Lenders generally will not approve applicants with recent late payments.

- Ask for higher credit limits. If you’ve been banking with an institution for more than a year, consider asking them to raise your credit limit. But be aware that this may result in a hard pull in your credit, so ask well in advance of applying for your loan!

- Just wait. The older your credit profile, the healthier your credit score. If you’ve recently applied for credit, you may need to wait for your credit accounts to age for a few months. Having at least five years of credit history is recommended.

By improving your credit score, you can also decrease your debt-to-credit ratio, which is a major financial factor when calculating interest rates.

Come Prepared

When you are ready to apply for RV financing, you should come prepared with the following information:

- Proof of income

- Proof of permanent address

- Proof of RV insurance

- 3 years of tax returns

- Type (year, make, model) of RV you wish to finance

- A defined budget

- List of major personal assets (homes, new cars, wealth)

- Copy of your credit report

Not all lenders will require this information. In particular, unsecured loans may only require proof of income, permanent address, and a credit score. However, the more information you bring, the more leverage you have.

Step 3. Choose Your Loan Type

Secured Financing

Most RV financing is offered as a secured loan with the RV itself as the collateral.

Lenders will offer you different rates and terms depending on your credit score, RV type and cost, and desired payment period.

The typical RV loan term is 1-15 years, with most being 3, 5, 7, or 10-year terms. Some institutions, such as LightStream, cap their terms at 84 months (7 years).

However, some lenders may offer loan terms as long as 20 years. Longer terms are generally offered for more expensive RVs, often over $50,000. Larger down payments may be required.

As with other loans, the shorter the term, the less you’ll pay in interest.

Check out this NerdWallet article for 2021 options for secured RV loans.

CONDITIONS

RV secured loans typically aren’t available for older RVs more than 10-15 years old. Some have maximum mileage restrictions (e.g., 75,000 miles) for motorhomes as well.

Most lenders have minimum and maximum borrowed amounts. Many have a minimum amount of $5,000 and a maximum amount of $50,000 or $100,000.

Unsecured / Personal Loan

Unsecured RV loans are usually some sort of personal loan, often offered by online banks and peer-to-peer lenders.

Unsecured loans do not require collateral. This forces the lender to accept much more risk, however, and the interest rates are usually much higher.

Unsecured loans are offered by lenders such as:

- LendingClub

- Upstart

- Best Egg

- Payoff

- Marcus

- Lightstream

CONDITIONS

It is very difficult to obtain an unsecured loan more than $30,000-$50,000, even with excellent credit. If you plan to finance a larger coach RV, you should expect a secured loan, with the RV title held as collateral.

Rent-To-Own

You also may be wondering about rent-to-own or lease-to-own contracts. While rarer than secured financing, lease-to-own programs are offered by some dealerships or private parties.

Like most rent-to-own contracts, you can obtain a rental loan for an RV with poor credit, or even no credit. Many programs simply require the following:

- Minimum 18 years old

- U.S. citizen or permanent resident

- Currently employed or receiving a steady income

- Owns bank account with direct deposit bill pay capability

CONDITIONS

However, because the average risk of default is relatively high and collateral is non-existent, lenders cover their bases by charging exorbitant interest.

Be prepared to pay for an RV twice over if you lease-to-own!

Step 4. Compare Lenders and Negotiate Price

Compare Lenders

Get quotes from at least three lenders before making a final decision.

Many people get financing through the RV dealership. This process is relatively quick and painless. In many cases, you can get same-day approval!

It is important to understand the dealership is not the one funding the loan. Dealers partner with lending institutions, such as SunTrust, to offer financing to consumers.

If you are obtaining financing through the RV dealership, read all the fine print first! You don’t want to accept a low interest rate if the contract details $2,000 in upfront processing and inspection fees.

Also, some dealerships may offer significant price reductions on the RV purchase price only to make it up by increasing the interest rate on the loan.

Don’t be afraid to ask questions! Be your own advocate. No one else will be.

Haggle Final Pricing with RV Dealership

If you are purchasing an RV from a dealership, be prepared to haggle with the dealer. Be willing to walk away and come back weeks later. Don’t appear desperate!

RVs are typically inflated 30-40 percent over dealer cost. This value is called the MSRP, although most dealerships plan to offer “discounts” and sell for 20-30 percent over their cost.

So don’t pay sticker price. Look at comparable trailers from nearby dealerships and use those as leverage to reduce the cost.

If possible, purchase an RV in the off-season, October – January.

You need to come prepared with a number in mind and how much the camper is actually worth. Don’t stray from your number without waiting at least 24 hours to sleep on it!

Special Instructions on RV Financing for Full-Timers

Many financial institutions get nervous about offering RV financing to full-timers.

Since full-timers travel across the country without a permanent residence, they are extremely difficult to track down. Plus, since the RV serves as the loan collateral, the bank is accepting a greater risk of collateral damage the more miles traveled.

RVs are also considered luxury purchases, unlike a car or a house. More stringent requirements apply.

Most financial institutions prefer that the RV owner own a home (or rent), even if they’re traveling all or most of the year. This is normally stated as a “home equity” requirement.

If you don’t own a home, some institutions will also consider another type of permanent address, such as a P.O. Box or UPS street address. Laws vary by state, but in many states, using a mailbox as a permanent address is legal and can be considered your residential address.

If you sell your home before purchasing an RV, many lenders will regard that as a big red flag. Be aware that many may not work with you if you don’t own a home and have no permanent address.

Some full-timers choose to cloak the fact that they will be traveling year-round in their RV. Not only is this legally gray, but they are also missing out on an important tax benefit. When you use your RV as a primary domicile, the interest is deductible.

As a general rule, credit unions seem to be more lenient than banks. Start by talking to a loan officer at your local credit union or online institution. Some institutions include:

- LightStream

- USAA

- Bank of the West

- Essex

- Fifth Third Bank

- Alliant Credit Union

For more information, we invite you to read this Investopedia article on RV loans and rates.

Parting Thoughts on RV Financing

Buying an RV is exciting! Enjoy the experience, but don’t let dealerships pressure you into purchasing an RV before you’re ready. Buy smart; travel happy.

Andy Herrick is a blogging nerd, #8 Enneagram, wannabe bread baker, INTJ, RV industry professional, and small business entrepreneur. He can be found hanging out with his lovely wife and family, skiing, cycling, climbing, hiking, and convincing anyone who will listen why dogs aren’t really that great of pets. Also, he runs this website.

-

Andyhttps://changingears.com/author/andrew-herrick/

-

Andyhttps://changingears.com/author/andrew-herrick/

-

Andyhttps://changingears.com/author/andrew-herrick/

-

Andyhttps://changingears.com/author/andrew-herrick/